Make Your Website Accessible — Comply with International Legislation & Standards

An Affordable, Efficient and Compliant Website Solution for ADA, WCAG, HB21-1110 in Colorado

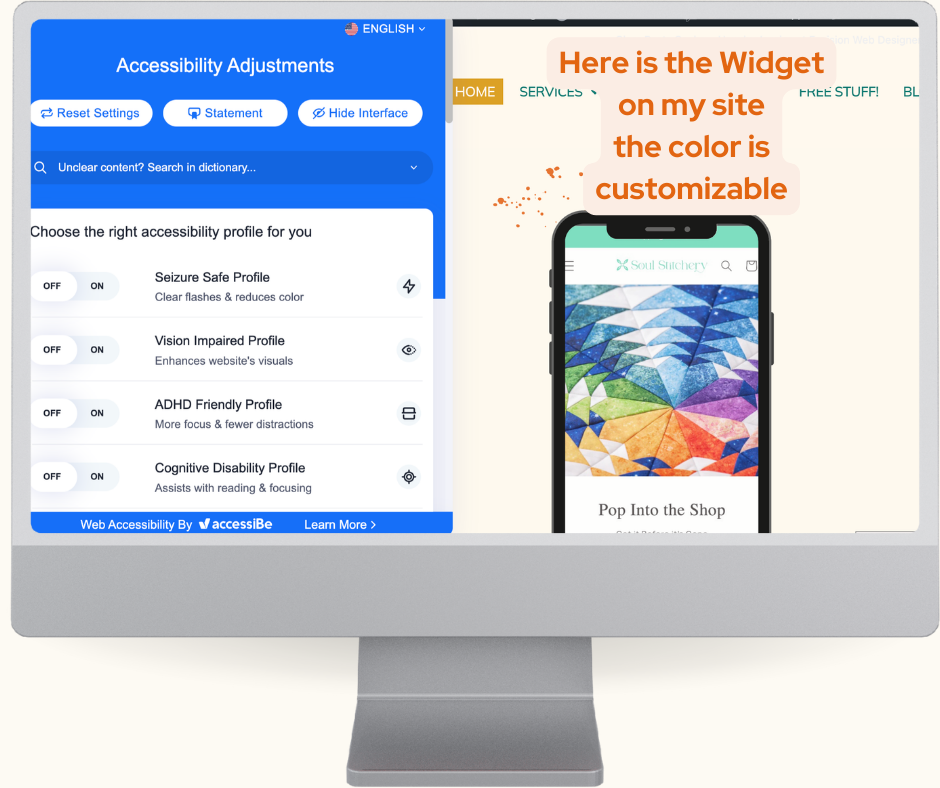

Go above and beyond WCAG requirements with the easy accessiBe website widget. It’s a win-win: avoid the risk of law suits while making your site accessible to everyone.

As of July 1, 2024 - All Colorado state agencies and local governments must be compliant with state standards as per HB21-1110

Not meeting these standards could mean injunctive relief, meaning a court order to fix the problem; actual monetary damages; or a fine of $3,500 payable to the plaintiff, who must be someone from the disability community.

other than simply being INCLUSIVE by making your site accessible, there are additional benefits to having a compliant website:

Google ranks SEO partly on Usability including Accessibility.

An SEMRush study found Accessible sites had a 12% increase in overall traffic.

Widen Your User Base with an ADA, WCAG and HB21-1110 Accessible Site

By opening up your website to the 15% of the global population that has a visual, auditory, motor, or cognitive impairment – you tap into a market with a spending power of $8 trillion (based on the Valuable 500 research

Brand Reputation by being ADA and WCAG Compliant

Brand reputation and social responsibility are crucial for businesses, and web accessibility is an essential part of this. In order to be in line with legislation and maintain a brand reputation, you should do something about web accessibility. Once you implement an accessibility solution, you will have an accessibility statement, and that says a lot about your brand.

ADA Tax Credits for an ADA Accessible Website

Automation allows you to significantly cut compliance costs and make web accessibility possible. Subscribing to the accessiBe widget costs your business just $490 per year per domain for websites under 1,000 pages. In addition, the price is even lower after tax credits!

What is the ADA tax credit?

The U.S. government promotes and supports accessibility practices that comply with the Americans with Disabilities Act (ADA) by incentivizing the efforts made and sustained with a tax credit.

Who is eligible to apply?

1. Any business that generated $1,000,000 or less during the year before filing.

2. Any business that employs 30 or fewer full-time employees in the previous tax year.

How to apply?

If your business fits one of these two qualifications talk to your tax preparer about form 8826.

Legal Consequences of Not Having an ADA and now HB21-1110 Compliant Site

In recent years, there has been a surge in state court lawsuits regarding web accessibility. 2023 saw a record-breaking number of lawsuits and demand letters under the Americans with Disabilities Act (ADA), with 4,605 lawsuits filed. It is estimated that only 3% of demand letters go to trial, as the majority, approximately 97%, are settled beforehand. This indicates that over 100,000 business owners received demand letters in 2023 for failing to make their websites accessible. Moreover, organizations and businesses can be fined up to $150,000 for ADA violations, while the average ADA website lawsuit settlement typically ranges from $20,000 to $50,000.

Get a Free ADA Compliance Website Audit

To learn whether or not your website is accessible for people with disabilities, we can get your website audited with accessScan, accessiBe’s free tool. It’s simple and quick. After that, we’ll know the status of your website and what to do next. You can scan it yourself by entering your domain in the ADA Compliance Website Scan yourself, or we can do it together and review the results.

A Litigation Support Package is also available as a unique service at AccessiBe should you be in need of mediating a complaint against your business site

Contact me today to install accessiBe's ADA Compliant Accessibility Widget on your Site